Our Smart Company (SC) Registration service in Croatia provides a professional and streamlined solution for businesses looking to establish a presence in this vibrant European market. Whether you are expanding from a non-EU country or diversifying your operations within the EU, we offer comprehensive support to navigate the legal and regulatory requirements of SC registration.

As part of our entity management services, we ensure that your blockchain business complies with Croatian corporate laws while leveraging the country’s favorable business environment. Our service encompasses everything from document preparation to liaising with local authorities, ensuring a seamless registration process. We understand the unique needs of blockchain ventures and tailor our approach to accommodate the specific regulatory and operational requirements of this innovative sector.

Our experienced team is dedicated to delivering tailored customer service for entity businesses, providing full facilitation throughout the registration process. From initial setup to ongoing compliance and expansion, we help strategically position your blockchain company for growth in Croatia and beyond.

From start to finish, we reduce administrative complexities, allowing you to focus on leveraging blockchain technology and expanding your business into European and international markets. With our support, you can navigate the intricacies of blockchain regulations and position your company for success in one of Europe's most dynamic business environments.

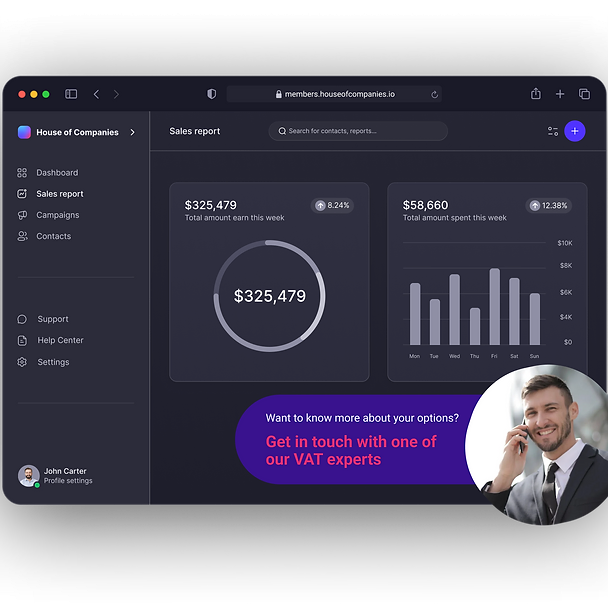

Registering a Smart Company (SC) in Croatia is now more efficient and flexible than ever with our state-of-the-art Self-Governance Portal. This innovative platform is designed to streamline your business setup process, integrating advanced blockchain technology to enhance transparency, security, and efficiency. Whether you're expanding into the EU or operating from a Croatian base in non-EU markets, our service offers a comprehensive solution for your corporate registration needs.

Our Self-Governance Portal leverages blockchain technology to ensure the integrity and immutability of your registration data. This cutting-edge approach not only provides enhanced security but also ensures that all transactions and document submissions are recorded transparently and in a tamper-proof manner.

Our Smart Company Registration service is an integral part of our broader entity management offerings, ideal for businesses looking to establish a strong foundation in Croatia and expand globally. Start your registration with confidence using our advanced Self-Governance Portal and benefit from the security and efficiency of blockchain technology. Expand your global presence and achieve long-term success with our expert support.

To begin your Smart Company registration, log into our Self-Governance Portal, where you will have full control over the registration process. The portal is designed to simplify your interaction with Croatian authorities, allowing you to manage necessary documentation and legal requirements in a streamlined and user-friendly interface.

Determine the type of Smart Company that best suits your business needs. You can choose from various structures depending on your industry, size, and business model. Our team of experts is available to guide you on which structure will provide the most benefit, both operationally and tax-wise.

The following documents are typically required to register a Smart Company in Croatia:

Our portal makes it easy to upload these documents securely, and we verify them to ensure compliance with Croatian regulations.

Through the portal, you can verify and reserve your company name to ensure it is unique and meets Croatian legal requirements. This step is crucial to avoid any conflicts or delays during the registration process.

Once your documents are in order, a notary will prepare and sign the Deed of Incorporation. This legal document formalizes the creation of your Smart Company, and we facilitate this step by coordinating with registered notaries to ensure everything is handled efficiently.

Your Smart Company must be officially registered with the Croatian Chamber of Commerce. Our portal connects you directly with the Chamber, ensuring seamless submission of all required documentation. Upon registration, your company will receive a unique registration number, confirming its legal status in Croatia.

To operate legally, your Smart Company must obtain a Croatian tax identification number (TIN) and a Value-Added Tax (VAT) number. Our team facilitates this process through our portal, ensuring your company is registered with the Croatian tax authorities without any hassle.

A corporate bank account is essential for financial operations. We can assist you in opening an account with a reputable Croatian bank, ensuring your business can transact smoothly both locally and internationally.

Once all steps are completed, you will receive final confirmation of your Smart Company’s registration, allowing you to officially start operations in Croatia. Our team remains on hand for any post-registration support, ensuring your company runs efficiently and complies with all legal requirements.

Registering a Smart Company (SC) in strategic jurisdictions can offer significant advantages depending on your business goals and operational needs. Each jurisdiction presents unique benefits, making it essential to choose the right one for your expansion plans.

Croatia is an emerging choice for Smart Company registration, offering a favorable business environment, strategic location within the EU, and a robust legal framework. Businesses registered in Croatia benefit from access to the EU market, competitive tax rates, and a skilled workforce. The country also boasts modern infrastructure, making it ideal for companies looking to expand within Europe.

Ireland: Known for its low corporate tax rate and strong pro-business policies, Ireland is an attractive destination for SC registration, providing easy access to the EU market.

Estonia: Renowned for its digital society and e-Residency program, Estonia offers a simplified company registration process, particularly appealing for tech and blockchain businesses.

Germany: As Europe’s largest economy, Germany offers a robust market for SC registration, characterized by a well-established legal framework and access to a diverse consumer base.

Switzerland: Known for its stability and favorable tax regimes, Switzerland is an attractive jurisdiction for businesses looking for a strong economic environment and privacy protections.

Establishing a blockchain business in Croatia provides unique advantages due to the country’s progressive regulatory environment and robust technological infrastructure. Our comprehensive guide will walk you through the key steps to setting up your smart blockchain business, ensuring you navigate the process efficiently and comply with local regulations.

Croatia is known for its favorable regulatory stance towards blockchain technology. Begin by familiarizing yourself with local laws and regulations related to blockchain, cryptocurrency, and digital assets. The Croatian government has established clear guidelines to support blockchain innovation while ensuring compliance with financial regulations and anti-money laundering requirements.

Selecting the appropriate business structure is crucial for your blockchain venture. Options include private limited companies (d.o.o.), joint stock companies (d.d.), and more. Each structure offers different benefits regarding liability, taxation, and operational flexibility. Our guide provides insights into choosing the structure that aligns with your business goals and blockchain operations.

Register your blockchain business with the Croatian Chamber of Commerce. The registration process involves submitting necessary documents such as the company name, articles of association, and proof of address. Our guide will detail the documentation required and the steps to ensure a smooth registration process.

Depending on your blockchain business activities, you may need specific licenses or permits, such as for operating a cryptocurrency exchange or providing financial services related to blockchain technology. Our guide outlines the types of licenses you may need and how to apply for them.

Opening a corporate bank account in Croatia is essential for managing your business finances. Banks in Croatia are becoming increasingly familiar with blockchain and cryptocurrency operations, making it easier to find a financial institution that meets your needs. Our guide offers tips on selecting the right bank and the documentation required.

Blockchain businesses in Croatia must comply with local tax regulations, including corporate tax and VAT. Understanding your tax obligations is crucial for maintaining compliance and optimizing your tax strategy. Our guide provides information on tax rates, reporting requirements, and how to manage your tax responsibilities.

Protecting your blockchain technology and innovations through intellectual property rights is essential. Croatia offers robust intellectual property protection, including patents and trademarks. Our guide explains the process of securing your intellectual property and the benefits it offers.

Ensuring ongoing compliance with Croatian and EU regulations is vital for your blockchain business. This includes adhering to anti-money laundering (AML) and know-your-customer (KYC) requirements. Our guide outlines how to develop a compliance strategy and implement effective measures to meet regulatory standards.

Croatia has a growing blockchain ecosystem with various industry associations, meetups, and conferences. Engaging with local networks can provide valuable insights, connections, and opportunities for collaboration. Our guide highlights key organizations and events to consider.

The regulatory landscape for blockchain is continually evolving. Staying informed about changes in laws and regulations is crucial for your business's success. Our guide emphasizes the importance of monitoring updates and adapting your business practices accordingly.

1. What is a Smart Company (SC)?

A Smart Company (SC) is a modern business entity that utilizes innovative technologies, such as blockchain, to enhance operational efficiency, transparency, and compliance. In Croatia, registering as a Smart Company can help you leverage the country’s favorable business environment.

2. Why should I register a Smart Company in Croatia?

Croatia offers a strategic location within the EU, a supportive regulatory framework, and access to a skilled workforce. Registering a Smart Company in Croatia can provide benefits such as reduced administrative burdens, favorable tax regimes, and opportunities for growth within European markets.

3. How can I start the registration process for a Smart Company in Croatia?

To begin the registration process, you can access our Self-Governance Portal. This platform allows you to manage your registration documents, choose the appropriate company structure, and submit the required paperwork directly to local authorities.

4. What documents are required to register a Smart Company in Croatia?

Typically, you will need to provide:

Our portal simplifies document submission and verification to ensure compliance.

5. How long does the registration process take?

The registration timeline can vary, but with our streamlined process and the use of advanced technology, most companies can expect to complete the registration within a few weeks, barring any unforeseen issues.

6. Do I need a local notary for registration?

No, our Self-Governance Portal allows you to avoid the traditional local notary requirements. We facilitate the preparation and signing of necessary legal documents, making the process more efficient.

7. What are the tax obligations for a Smart Company in Croatia?

Smart Companies in Croatia must comply with local tax regulations, including corporate tax and VAT. Our team can assist you in understanding your tax obligations and optimizing your tax strategy for compliance and efficiency.

8. Can I open a corporate bank account in Croatia as a foreign business?

Yes, once your Smart Company is registered, you can open a corporate bank account with a local bank. Our services include guidance on selecting the right bank and the documentation needed to facilitate the process.

9. What support does House of Companies offer after registration?

After your Smart Company is registered, House of Companies continues to provide ongoing support for compliance, operational issues, and any future expansions you may wish to undertake. Our team remains available to assist you with any questions or challenges you encounter.

10. How do I know if a Smart Company registration is right for my business?

To determine if a Smart Company registration aligns with your business goals, we encourage you to explore our blogs and roadmaps, which outline the pros and cons for registering in Croatia. You can also contact our team for personalized advice based on your specific needs.

"I was initially unsure about registering a Smart Company in Croatia, but the resources provided by House of Companies made the decision much clearer. Their blogs and roadmaps highlighted the pros and cons effectively, allowing me to make an informed choice. The incorporation process was seamless, and their team was incredibly supportive throughout!"

Alex JFounder of Tech Innovators Inc.

Alex JFounder of Tech Innovators Inc."The business landscape in Croatia can be challenging, but House of Companies made it easy. Their insights into the benefits and drawbacks of different company structures were invaluable. With their assistance, I successfully incorporated my business and feel confident moving forward. Highly recommend their services!"

Maria LCEO of Global Ventures Ltd.

Maria LCEO of Global Ventures Ltd."I was looking to expand my operations into Croatia and needed clarity on the best registration options. The comprehensive information provided by House of Companies helped me understand the advantages of a local incorporation. Their professional support during the registration process was exceptional, and I couldn't be happier with the results!"

David RDirector at InnovateTech Solutions

David RDirector at InnovateTech SolutionsThe registration of a Smart Company (SC) may not be the most suitable option for everyone. In our Blogs and Roadmaps, we provide a detailed analysis of the pros and cons of registering a Smart Company in Croatia compared to other business structures.

If you choose to incorporate a local company, House of Companies is here to assist you throughout the incorporation process. Our experienced team will guide you in navigating the local regulations and ensure a smooth setup for your business in Croatia.

Feel welcome, and try out our solutions and community, to bring your business a step closer to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!