House of Companies is thrilled to offer our clients the most cutting-edge bookkeeping services in Croatia.

Our team of experts is equipped with the latest tools and technologies, enabling us to deliver innovative solutions tailored to meet your unique needs. With advanced and next-level support, you can rest assured that your bookkeeping needs are in the best possible hands. Let's get started!

Automated OSS filing for ecommerce and import traders.

Close your financial year, and prepare Financial Statements at a click of a button!

Automate your VAT filing in Croatia and simplify growth.

Ready to branch out to Croatia and beyond? Manage your entity and your growth!

It's becoming simpler and simpler every day to deliver and process invoices, bank statements, and even agreements (such as your lease). The procedure of submitting your data is made simpler by House of Companies using a single source for all documents, data, and reports.

You can track our progress, and your profits, in real-time!

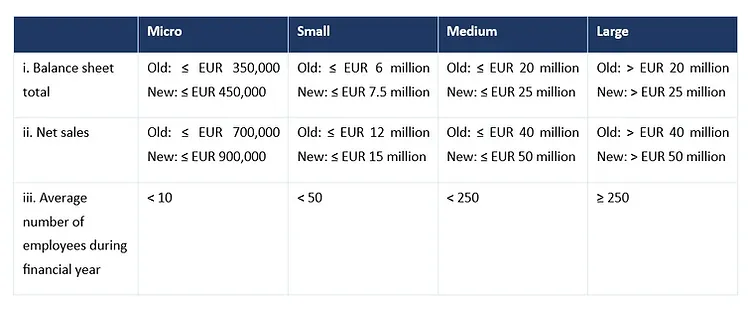

Croatia has a comprehensive legal framework governing financial reporting, primarily based on the EU Accounting Directive 2013/34/EU and incorporated into the Croatian Accounting Act. This framework is supplemented by the Croatian Financial Reporting Standards (CFRS) issued by the Croatian Financial Reporting Standards Board, judicial precedence, and International Financial Reporting Standards (IFRS) as adopted by the EU.

Entities with securities other than shares listed on a regulated market in the EU/EER must comply with additional reporting requirements under the Croatian Capital Market Act. These requirements include publishing annual financial reports within four months of the end of the financial year and half-yearly financial reports within three months after the first six months of the financial year.

The annual financial reporting comprises the management board report, audited financial statements, other information, and statements made by the management board attesting to the true and fair view presented by the financial statements and management board report. Entities active in the extractive industry or primary forest logging must also publish an annual report on payments to governments within six months of the financial year-end.

For corporate tax purposes, a Croatian company with substance, i.e., a permanent establishment (PE), is subject to corporate income tax (CIT) on its worldwide income. In contrast, a non-resident company without a PE in Croatia is only liable for CIT on Croatian-source income, such as profits from a PE or income from Croatian real estate.

The term 'permanent establishment' is defined in the CIT law and follows the definition in the applicable tax treaty for treaty situations. For non-treaty situations, the definition aligns with Article 5 of the OECD Model Convention 2017.

Regarding value-added tax (VAT), a Croatian company with substance must register for VAT and charge VAT on its supplies of goods and services.

A non-resident company without a PE in Croatia may still be required to register for VAT if it makes taxable supplies in Croatia, such as distance sales or e-services to non-VAT registered customers.

In summary, the presence of a permanent establishment is a crucial factor in determining the corporate tax and VAT obligations of a company operating in Croatia.

Non-resident entities seeking to establish a presence in Croatia have several legal entity options to choose from, each with its own set of accounting and tax implications. The most common types include branch offices, subsidiaries, and foreign legal structures.

A branch office, also known as a permanent establishment (PE), is not a separate legal entity but an extension of the foreign company. It must be registered with the Croatian Chamber of Commerce and is subject to corporate income tax and value-added tax (VAT) on profits attributable to the branch. The branch office is not required to file separate financial statements with the Chamber, but the parent company's financial statements must be submitted.

Subsidiaries, on the other hand, are independent legal entities incorporated under Croatian law. They must register with the Chamber, file annual financial statements, and comply with all Croatian tax obligations, including corporate income tax, VAT, and wage tax. Subsidiaries offer greater administrative simplicity and independence compared to branch offices.

Foreign companies can also opt to use their own country's legal structure when setting up a business in Croatia. Croatian company law recognizes all foreign business structures except sole proprietorships. However, using a foreign legal structure may have certain disadvantages, such as increased complexity in dealing with multiple tax authorities.

Registering a branch office in Croatia entails several accounting obligations. The branch must maintain proper books and records, and the foreign company's financial statements must be filed with the Croatian Chamber of Commerce. If the branch has employees, it must set up a Croatian payroll and withhold wage tax and social security premiums.

The branch office's profits are subject to Croatian corporate income tax, and it must file quarterly VAT returns. Transfer pricing rules apply to transactions between the branch and its foreign head office, necessitating proper documentation to substantiate the allocation of profits.

The decision between establishing a branch office, subsidiary, or using a foreign legal structure depends on various factors, including the nature and extent of activities in Croatia, tax considerations, and administrative simplicity. Non-resident entities should consult with legal and tax advisors to determine the most suitable option for their specific situation.

Croatia operates a Value Added Tax (VAT) system, not a traditional sales tax. VAT is applied at each stage of production and distribution, unlike sales tax, which is typically only applied at the point of sale to the end consumer. In Croatia, the standard VAT rate is 25%, with reduced rates of 13% and 5% for specific goods and services.

Non-resident entities operating in Croatia must comply with various tax registration requirements to ensure compliance with Croatian regulations. These obligations include registering for value-added tax (VAT), payroll taxes, and corporate income tax, depending on the nature and extent of their business activities in the country.

Businesses engaged in VAT taxable transactions in Croatia are required to register for a Croatian VAT number. This applies to both resident and non-resident companies supplying goods or services within the country.

The registration process involves submitting an application to the Croatian Tax Administration, providing necessary documentation such as proof of business incorporation and identification documents, and appointing a fiscal representative for non-resident businesses.

Once registered, companies must charge VAT on their supplies, file periodic VAT returns, and maintain proper records of their transactions. The standard VAT rate in Croatia is 25%, with reduced rates applicable to certain goods and services. Non-compliance with VAT obligations can result in penalties and legal consequences.

Businesses employing staff in Croatia are obligated to register as an employer with the Croatian Tax Administration and deduct payroll taxes from their employees' wages. Payroll taxes include wage tax, national insurance contributions, and employee insurance premiums. Employers must file payroll tax returns and remit the withheld amounts to the tax authorities.

Before employing staff, companies must register as an employer and obtain a payroll tax number. They are also required to verify their employees' identities and eligibility to work in Croatia. Failure to comply with payroll tax obligations can lead to penalties and legal repercussions.

Resident companies in Croatia are subject to corporate income tax on their worldwide income. The standard corporate income tax rate is 18%, with a lower rate applicable to small businesses. Companies must file annual corporate income tax returns and make advance payments throughout the year.

Non-resident companies are liable for corporate income tax only on their Croatian-source income, such as profits attributable to a permanent establishment in Croatia. They are required to file corporate income tax returns and pay taxes on their taxable income.

To ensure compliance with Croatian tax regulations, non-resident entities should seek professional advice from tax consultants or legal experts familiar with the Croatian tax system. Staying informed about tax obligations and deadlines is crucial to avoid penalties and maintain good standing with the Croatian tax authorities.

Non-resident entities operating in Croatia are subject to various bookkeeping and financial reporting obligations under Croatian law. These requirements are primarily governed by the Croatian Accounting Act and the Croatian Financial Reporting Standards (CFRS).

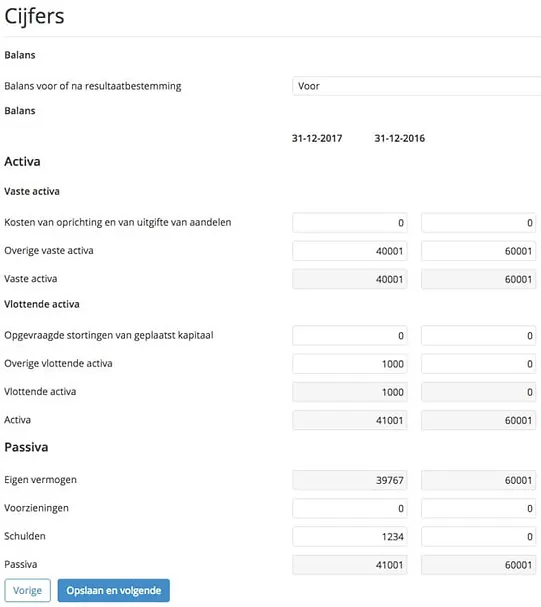

Almost every Croatian corporate entity is required to prepare financial statements according to the law, usually incorporated in the entity's statutes. The financial statements serve as an essential building block for the Croatian legal system and form the basis for corporate governance. They are also relevant for taxation, as they serve as the starting point for determining the taxable basis, although tax laws have independent rules.

Depending on the company's size and publication requirements, the financial statements generally must contain at least:

The financial statements should accurately reflect the company's financial position, and the accounting principles used must be set out in the financial statements. These principles, once implemented, may only be changed if there are good reasons for such a change, and the reasons and effect on the company's financial position must be disclosed in the notes.

Parent companies should generally include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements.

A "controlled subsidiary" is a legal entity in which the company can directly or indirectly exercise more than 50% of the voting rights at the shareholders' meeting or is authorized to appoint or dismiss more than half of the managing and supervisory directors.

Consolidation may be omitted under certain conditions, such as when the subsidiary or group company meets the criteria for being described as a small company for Croatian statutory purposes or when the financial information has been included in the parent company's consolidated financial statements prepared per the EU Directive.

Only medium and large companies and companies that apply IFRS are legally obliged to have their annual report audited by an independent, qualified, and registered Croatian auditor.

The auditor's report must include whether the financial statements provide information under the accounting principles generally accepted in Croatia and accurately represent the financial position and result for the year.

The financial statements must be prepared and approved by the managing directors no later than four months after the end of the financial year, with a possible extension of up to two months.

Non-resident entities must comply with these bookkeeping and financial reporting requirements to ensure compliance with Croatian regulations and maintain transparency in their business operations.

Under Croatian law, almost every corporate entity is required to prepare financial statements according to the entity's statutes, which serve as an essential building block for the Croatian legal system and form the basis for corporate governance. The financial statements are also relevant for taxation, as they serve as the starting point for determining the taxable basis, although tax laws have independent rules.

The content of the financial statements depends on the company's size and publication requirements but generally must contain at least a balance sheet, a profit and loss account, and notes to the accounts. The financial statements should accurately reflect the company's financial position, and any changes in accounting principles must be disclosed in the notes.

Parent companies should generally include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements. However, consolidation may be omitted under certain conditions, such as when the subsidiary or group company meets the criteria for being described as a small company for Croatian statutory purposes or when the financial information has been included in the parent company's consolidated financial statements prepared per the EU Directive.

Only medium and large companies and companies that apply IFRS are legally obliged to have their annual report audited by an independent, qualified, and registered Croatian auditor. The auditor's report must include whether the financial statements provide information under the accounting principles generally accepted in Croatia and accurately represent the financial position and result for the year.

The financial statements must be prepared and approved by the managing directors no later than four months after the end of the financial year, with a possible extension of up to two months. The publication requirements vary depending on the company's size.

Online bookkeeping services have become essential for businesses in Croatia seeking to streamline their financial operations. These services offer a comprehensive range of features tailored to meet the specific needs of startups and large enterprises alike. By leveraging technology and expertise, online bookkeeping providers deliver accurate financial reports and efficient management of financial data, all while adhering to Croatian regulations.

The expertise level of the virtual bookkeeping team is crucial in determining the quality of service. Many providers employ trained and qualified bookkeepers who understand the unique challenges of various industries, including e-commerce. These experts are often certified in popular cloud accounting software like Xero and specialized e-commerce accounting apps such as A2X. Their knowledge allows them to implement technology solutions that simplify accounting for marketplace and platform payouts, ensuring compliance with Croatian accounting standards.

Virtual bookkeeping services pricing can vary significantly depending on the pricing model chosen by the business. Understanding these models helps businesses make informed decisions about their financial management. Common pricing structures include:

Factors influencing pricing include the scope of services, geographic location, and the level of customization required. Businesses should be aware of potential hidden costs and look for providers that offer scalability in their pricing plans, all while ensuring compliance with Croatian financial regulations.

Online bookkeeping services typically offer a wide array of features designed to support businesses effectively:

Advanced features may include stock valuation services, implementation of control account reconciliations, and support for VAT/GST returns across different countries. Many providers also offer cloud-based solutions, ensuring round-the-clock access to financial data and enhanced security measures to protect sensitive information, all while adhering to Croatian regulations.

By choosing the right online bookkeeping service, businesses can benefit from increased efficiency, improved accuracy, and valuable insights into their financial health, allowing them to focus on core business activities while ensuring their finances are managed professionally.

Industry-specific bookkeepers bring a wealth of knowledge that extends beyond basic accounting principles. They possess a deep understanding of sector-specific regulations, tax implications, and financial best practices in Croatia. This expertise allows them to:

Their ability to work with a wide range of stakeholders, from customers to senior management, makes them adept at managing complex relationships within the business ecosystem.

Pricing models for industry-specific bookkeepers often reflect the specialized nature of their services. While some firms may offer fixed rates or predetermined packages, many adopt more flexible approaches:

This flexibility in pricing allows businesses to access high-quality services that align with their budget and specific industry demands.

Industry-specific bookkeepers offer a range of features designed to meet the unique challenges of different sectors:

These features enable businesses to benefit from:

The rise of technology-driven finance and accounting services has further enhanced the capabilities of industry-specific bookkeepers. They leverage AI-based accounting software, cloud computing, and automation to increase productivity and lower operational costs for their clients, all while ensuring compliance with Croatian regulations.

Virtual bookkeeping assistants have become an invaluable resource for businesses in Croatia seeking to streamline their financial management processes.

These skilled professionals offer remote support, managing financial records, transactions, and reporting processes with efficiency and accuracy. By leveraging advanced accounting software and tools, virtual bookkeeping assistants handle a wide range of tasks, from data entry and reconciliations to payroll processing and expense tracking, all while adhering to Croatian regulations.

Virtual bookkeeping assistants bring a wealth of knowledge and skills to the table. They possess a deep understanding of accounting principles and are well-versed in using various cloud accounting software platforms. Their expertise extends to managing balance sheets, delivering income statements, streamlining financial resources, and preparing custom reports. These professionals have the ability to work with a wide range of stakeholders, from customers to senior management, making them adept at managing complex relationships within the business ecosystem.

Many virtual bookkeeping assistants have extensive experience in their field, with some having worked in the industry for over a decade. They undergo regular training to stay updated on the latest accounting standards, tax regulations, and reporting requirements specific to Croatia. This ensures that businesses receive accurate and compliant financial services.

The cost of hiring a virtual bookkeeping assistant can vary significantly based on several factors. Pricing models often include hourly rates, fixed monthly retainers, or project-based fees. Hourly rates for virtual bookkeeping assistants can range from EUR 0.79 to over EUR 78.56, depending on their experience and the complexity of the tasks involved.

For businesses looking for more consistent support, many virtual bookkeeping services offer monthly subscription plans. These plans often come in tiers, allowing companies to choose the level of service that best fits their needs and budget. Some providers offer flat rates for a certain number of hours worked per week or month, providing predictability in costs.

It's important to note that pricing can also be influenced by the virtual assistant's location. Assistants based in countries with lower costs of living often charge less than their counterparts in Croatia, without necessarily compromising on quality.

Virtual bookkeeping assistants offer a comprehensive range of features designed to support businesses effectively. These include:

Before beginning the search for a bookkeeper, it's essential to clearly define the company's bookkeeping needs. Croatian businesses must prepare financial statements that provide a true and fair view of their financial performance and position. These statements typically include a balance sheet, profit and loss account, and notes to the financial statements. Large and medium-sized companies are also required to publish management reports.

Companies should consider whether they need assistance with:

Ensuring compliance with Croatian accounting standards and EU directives

While cost is an important factor, it shouldn't be the sole determinant in choosing a bookkeeper. Croatian companies should weigh the potential benefits against the costs of hiring a professional. Outsourcing bookkeeping services can provide access to specialized expertise and advanced technologies without the need for in-house hiring and training.

Consider the following when assessing cost-effectiveness:

By carefully evaluating these aspects, Croatian businesses can select a bookkeeper who not only meets their financial management needs but also contributes to their overall efficiency and compliance with Croatian and EU regulations.

Expanding to a new market has never been easier. Our one-stop-shop portal simplifies your transition by handling everything from your new address and business setup to opening a bank account, obtaining a VAT ID, and becoming an employer, all in compliance with Croatian regulations and supported by local government agencies.

From A to Z, House of Companies provides guidance in your VAT registration registration, also for non-domestic companies.

Register your non-domestic company as employer in numerous EU countries, without hefty fees or local company formation!

Our subscription allows you to file tax returns directly at the local (online) Tax Portal, using the VAT analysis that we prepare. If needed we can submit on your behalf.

Register your non-domestic company as employer in numerous EU countries, without hefty fees or local company formation!

"I expected it would take about two quarters to generate turnover in Germany. Fortunately, I didn’t have to spend any money on an accountant in the meantime, thanks to the efficient support from House of Companies in Croatia."

Global Talent Recruiter

Global Talent Recruiter"My accountant in India drafts my VAT reports and submits the return using House of Companies' Entity Management services in Croatia!"

Spice & Herbs Export

Spice & Herbs Export"The practical know-how in Entity Management provided by House of Companies made me comfortable to get more involved in my own tax filing, and it worked perfectly!"

IT Firm

IT FirmYour situation might require the expertise of a local tax professional, especially given the complex and evolving nature of tax and accounting regulations in Croatia. In some cases, Croatian law mandates the involvement of a local accountant.

If you need assistance with filing your tax return, House of Companies is here to support you. You can either send us your existing ledgers and VAT analysis, or instruct us to create new ones from scratch, ensuring compliance with Croatian regulations and leveraging our local expertise.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!