At House Companies, we're excited to provide our clients with top-notch bookkeeping services in Croatia! Our skilled team uses the latest tools to deliver custom solutions that fit your specific needs.

With our advanced support, you can be sure your books are in good hands. Let's begin!

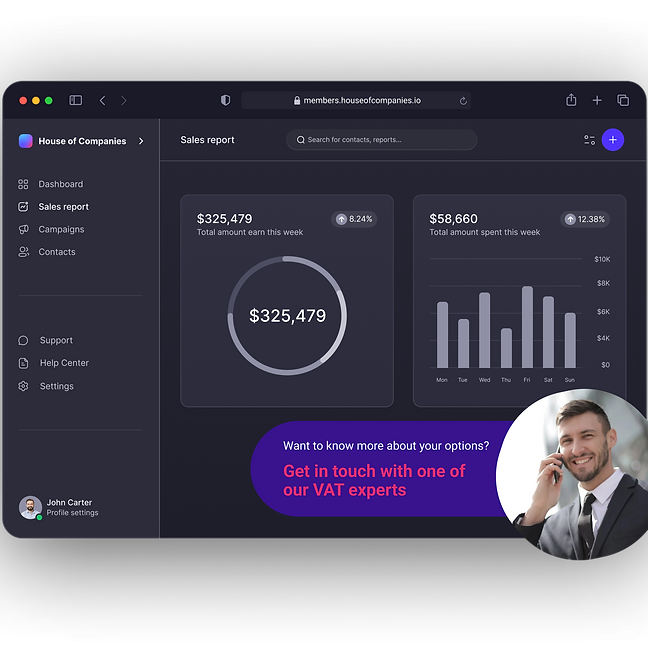

Handling invoices, bank statements, and even contracts (like your rental agreement) is getting easier every day. House of Companies makes submitting your information simpler by using one place for all documents, data, and reports. You can see our work and your earnings in real-time!

Managing your bookkeeping in Croatia doesn't have to be a hassle. With House of Companies, you gain access to a streamlined, efficient process that simplifies your financial management.

Even though tax and accounting rules keep changing, you might still need a local tax expert. Some countries actually require you to have a local accountant by law.

If you need help with your tax return, House of Companies is here for you.

You can send us your current ledgers and VAT Analysis, or ask us to create new ones from scratch

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!