Our Ecommerce OSS (One-Stop-Shop) Filing service is tailored to help businesses in Croatia navigate the EU VAT requirements for cross-border sales. As EU regulations require VAT collection on B2C goods and services across member states, we simplify the process by consolidating all VAT obligations into a single, streamlined report.

By using our service, your business can accurately track and report EU sales, helping you avoid the complications of filing separate returns for each country.

Our experienced team manages the administrative tasks associated with VAT filings, which includes collecting VAT for each EU country and remitting it on your behalf to the Croatian tax authority. This not only reduces the administrative load but also ensures compliance with EU-wide VAT requirements, freeing you to focus on your core business activities.

We prioritize accuracy and efficiency in every step, reducing the risk of costly filing errors or penalties. Additionally, with our support, your company can stay ahead of any regulatory changes that may affect your VAT filings. Partnering with us ensures your Croatian business operates smoothly in the EU market, giving you the confidence to expand and meet customer demands without worrying about tax complications.

Content Summary:

Let me know if you’d like further customization!

Document Extraction And Data Validation

Simplifies cross-border VAT compliance, making it easy for businesses to file one VAT return for all EU sales.

Reduces administrative effort, as our experts manage VAT obligations across EU member states on your behalf.

Provides reliable, on-time filing services to ensure compliance with Croatia's tax authority and EU requirements.

Minimizes costly errors and delays with our detailed, accuracy-driven VAT filing process for your ecommerce transactions.

Enhances your ability to focus on growth by letting us handle your complex, multi-country VAT requirements.

Offers peace of mind knowing your OSS filing meets Croatian and EU compliance standards seamlessly.

“Their OSS services in Croatia have streamlined our VAT filing process, allowing us to expand quickly.”

Sarah J.,Ecommerce Business Owner

Sarah J.,Ecommerce Business Owner“Excellent service! Their team simplified complex VAT filings for our EU sales, saving us time.”

John M., International Retailer

John M., International Retailer“We were overwhelmed by VAT requirements in Croatia, but they handled everything efficiently and professionally.”

Linda K.,Digital Marketing Specialist

Linda K.,Digital Marketing SpecialistFeel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

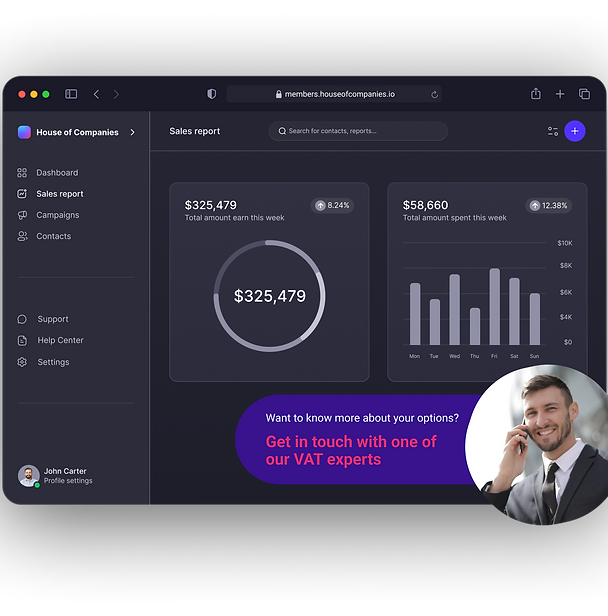

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!