Efficient tax filing services in Croatia are essential for businesses navigating the complexities of the local tax system. These services offer expertise in Croatian taxation, including VAT, corporate tax, and income tax, helping businesses avoid penalties and ensure compliance.

Tax professionals provide personalized solutions tailored to each company's needs, allowing for optimized tax strategies that can lead to significant savings. Many firms utilize advanced software to enhance accuracy and efficiency, streamlining the filing process and improving record-keeping.

Outsourcing tax filing allows business owners to concentrate on core operations, increasing productivity and resource allocation. Additionally, these services keep clients updated on changes in tax legislation, ensuring compliance while maximizing tax benefits. Overall, efficient tax filing services are invaluable for businesses looking to succeed in Croatia’s competitive market.

In Croatia, accounting services are crucial for businesses to ensure compliance with local regulations. These firms specialize in maintaining accurate financial records, which are essential for legal adherence and reliable financial reporting.

In addition to bookkeeping, Croatian accountants prepare financial statements that meet local laws, enhancing transparency for investors and lenders. They also navigate the complexities of tax compliance, assisting businesses with VAT, income tax, and corporate tax obligations, ensuring timely and accurate filings to avoid penalties.

Moreover, accounting services provide strategic financial advice, including budgeting and forecasting, aiding businesses in informed decision-making. Outsourcing these services can lead to cost savings by eliminating the need for an in-house team.

Overall, utilizing Croatian accounting services is vital for maintaining compliance, fostering growth, and successfully navigating the evolving business landscape in Croatia.

In today's dynamic business landscape, effective financial management is crucial for maximizing profits. Utilizing professional accounting services in Croatia can significantly enhance your business operations and profitability. One of the key benefits is the tailored approach that entity management services provide, ensuring your specific needs are met.

Croatian accounting firms offer comprehensive solutions, including bookkeeping, financial reporting, and tax compliance. These services not only streamline your financial processes but also allow you to focus on core business activities, leading to increased efficiency and productivity.

Moreover, partnering with experts in entity management ensures that your business adheres to local regulations and standards, reducing the risk of costly penalties. A proactive accounting service can help identify potential tax savings and financial opportunities, contributing to your overall profit growth.

Additionally, these services offer valuable insights into your financial health through regular analysis and reporting. By understanding your financial position, you can make informed decisions that drive growth and enhance profitability.

Croatia’s accounting framework is primarily governed by the Accounting Act, which aligns with European Union directives. This act ensures that all businesses maintain transparent and accurate financial records.

Companies must adhere to the International Financial Reporting Standards (IFRS) if they meet specific size criteria. Smaller entities can opt for simplified reporting under the national accounting standards.

Financial statements must be prepared annually, consisting of the balance sheet, income statement, and cash flow statement. These documents provide a comprehensive view of the company’s financial health.

Auditing is mandatory for larger companies, ensuring compliance with legal and regulatory requirements. Auditors play a crucial role in verifying the accuracy of financial statements.

Additionally, businesses must keep accounting records for a minimum of 11 years. This retention period is vital for tax purposes and financial audits.

The Croatian Tax Administration oversees tax compliance, providing guidelines on VAT, corporate tax, and other relevant taxes. Companies are required to register for tax purposes and submit periodic tax returns.

Accounting software is widely used in Croatia, facilitating compliance with regulations and streamlining financial reporting. Many businesses utilize digital tools to enhance accuracy and efficiency.

Setting up a branch office in Croatia involves several accounting implications that businesses must consider. First, companies need to register with the Croatian tax authority and obtain a tax identification number. It's crucial to comply with local accounting standards, which may differ from international practices. Branches must maintain proper financial records and submit annual financial statements in accordance with Croatian law. Additionally, businesses should be aware of value-added tax (VAT) regulations and the implications of transfer pricing. Engaging a local accounting firm can help ensure compliance and facilitate smooth operations in the Croatian market.

When establishing a branch office in Croatia, businesses must adhere to specific tax registration requirements. Key steps include:

Registration with the Tax Authority: Companies must register with the Croatian Tax Administration to obtain a tax identification number (OIB), essential for conducting business and fulfilling tax obligations.

Value Added Tax (VAT) Registration: If the branch's taxable turnover exceeds the VAT threshold, it must register for VAT. This allows the business to charge VAT on sales and reclaim VAT on purchases.

Corporate Income Tax Registration: Branches are subject to corporate income tax, and registration is required to file annual tax returns.

Local Tax Registration: Depending on the municipality, additional local taxes may apply, necessitating further registration.

Employee Tax Registration: If hiring employees, the branch must register for payroll taxes and social security contributions.

Ensuring compliance with these requirements is essential for operating legally and efficiently in Croatia.

Corporate tax liability for resident companies involves various factors, including the tax rate, deductions, and compliance requirements. In Croatia, resident companies are subject to a corporate income tax rate of 18%, with a reduced rate of 12% for companies with revenue below a certain threshold.

To effectively manage tax liabilities, businesses can utilize global entity management services. These services help companies navigate the complexities of local tax regulations, ensuring compliance with filing deadlines and reporting requirements.

Additionally, they assist in optimizing tax positions by identifying eligible deductions and incentives, ultimately enhancing financial performance and minimizing tax risks.

Financial statements provide a structured overview of a company's financial performance and position. They typically include:

Income Statement: This outlines revenues, expenses, and profits over a specific period, helping to assess profitability.

Balance Sheet: This snapshot presents assets, liabilities, and equity at a particular date, indicating the company’s financial position.

Cash Flow Statement: This details cash inflows and outflows from operating, investing, and financing activities, showing how cash is generated and used.

Statement of Changes in Equity: This explains changes in equity accounts, including issued shares and retained earnings, over a reporting period.

Notes to Financial Statements: These provide additional context and detail, explaining accounting policies, assumptions, and specific entries in the financial statements.

Together, these components offer a comprehensive view of a company’s financial health and operational results.

Consolidation requirements refer to the accounting practices and regulations that govern the process of combining the financial statements of a parent company and its subsidiaries into a single set of financial statements. Here are the key aspects:

Control: The parent company must have control over the subsidiary, typically defined as owning more than 50% of the voting rights or having the ability to direct its financial and operating policies.

Uniform Accounting Policies: Both the parent and subsidiaries should use consistent accounting policies to ensure accurate consolidation.

Reporting Periods: Financial statements of all entities should be prepared for the same reporting period. If they are not, adjustments may be necessary.

Elimination of Intercompany Transactions: Any transactions between the parent and subsidiaries, such as sales, loans, or dividends, must be eliminated to avoid double counting.

Non-controlling Interests: If the parent does not own 100% of a subsidiary, the equity attributable to non-controlling interests must be presented in the consolidated financial statements.

Compliance with Standards: Consolidation must adhere to relevant accounting standards, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Disclosure Requirements: Adequate disclosures must be provided in the consolidated financial statements to inform users about the nature of the relationships between the parent and its subsidiaries.

Understanding these requirements is crucial for accurate financial reporting and compliance with regulatory frameworks.

When establishing a branch office in Croatia, understanding the audit requirements is essential for compliance. All companies, including branches of foreign entities, must adhere to local regulations regarding financial audits.

Mandatory Audits: Branches are required to undergo annual audits if they exceed specific thresholds related to total revenue, total assets, or number of employees, as defined by Croatian law.

Auditor Selection: Audits must be conducted by a licensed external auditor registered in Croatia.

Audit Reports: The auditor’s report must be submitted to the Croatian Financial Agency and made available to relevant stakeholders.

Compliance with IFRS: Depending on the nature of the operations, branches may also need to prepare their financial statements according to International Financial Reporting Standards (IFRS).

Documentation: Accurate and timely documentation of all financial transactions is critical to facilitate the audit process and ensure compliance with Croatian accounting standards.

Engaging a local audit firm can streamline this process and ensure adherence to all regulatory requirements.

When establishing a branch office in Croatia, businesses must adhere to specific publication requirements to ensure compliance with local laws. Key obligations include:

Registration with the Court: The branch must be registered with the competent commercial court, which involves submitting necessary documentation such as the decision to establish the branch, the parent company's registration certificate, and the appointment of a representative.

Financial Statements: Annual financial statements must be prepared in accordance with Croatian accounting standards and filed with the tax authority. These documents typically need to be published in the official gazette.

Changes in Information: Any changes regarding the branch (e.g., address, management, or business activities) must be promptly updated in the public register.

Tax Registration: The branch must register for VAT if applicable and comply with local tax reporting requirements.

Ensuring these publication requirements are met is essential for legal compliance and maintaining the branch’s good standing in Croatia.

Annual accounts filing is a critical component of global entity management services. These services help businesses ensure compliance with local regulations while operating across multiple jurisdictions.

Companies must prepare and file annual financial statements, which often include balance sheets, income statements, and cash flow statements, in accordance with local accounting standards. Global entity management services streamline this process by providing expert guidance on regulatory requirements, deadlines, and reporting formats specific to each country.

By leveraging these services, organizations can reduce the risk of non-compliance, enhance transparency, and focus on their core operations while maintaining global accountability.

Audit requirements for non-resident entities operating in a country can vary based on local regulations. Here are some common considerations:

Local Laws and Regulations: Non-resident entities may be subject to the audit requirements of the jurisdiction where they conduct business. This often includes compliance with local accounting standards and reporting obligations.

Thresholds for Audits: Many countries establish specific revenue or asset thresholds that determine whether an entity must undergo an audit. Non-residents exceeding these thresholds may need to prepare audited financial statements.

Local Audit Firms: Non-resident entities typically need to engage a local audit firm to conduct the audit. This firm must be familiar with local regulations and accounting practices.

Tax Compliance: Auditors may review financial statements to ensure compliance with local tax obligations, including the proper reporting of income and deductions.

Regulatory Reporting: In some jurisdictions, non-resident entities must file certain reports with local authorities, which may require audit verification.

Currency Considerations: Non-resident entities may need to report their financials in the local currency, necessitating additional considerations in financial reporting and audits.

Documentation and Record-Keeping: Non-residents must maintain accurate financial records in accordance with local regulations, as auditors will rely on these documents during the audit process.

Understanding these requirements is crucial for non-resident entities to ensure compliance and avoid penalties in the jurisdiction where they operate.

When comparing Croatian GAAP (Generally Accepted Accounting Principles) with IFRS (International Financial Reporting Standards), several key differences and similarities emerge, particularly for entities operating in Croatia.

Regulatory Framework:

Measurement and Recognition:

Financial Statement Presentation:

Disclosure Requirements:

Basic Accounting Principles:

Adaptation to Changes:

For companies in Croatia, the choice between Croatian GAAP and IFRS often depends on their size, nature, and whether they are publicly traded. While Croatian GAAP may suffice for smaller entities, adopting IFRS can enhance transparency and facilitate international operations, particularly for businesses looking to attract foreign investment. Understanding these differences is crucial for effective financial reporting and compliance in the Croatian market.

Receiving or paying dividends to or from your group company involves several financial and regulatory considerations.

When receiving dividends, it's essential to account for the income correctly, ensuring compliance with applicable tax laws. The parent company must recognize the dividend income in its financial statements, which may also affect its tax liabilities depending on the jurisdiction.

Conversely, when paying dividends to a group company, ensure that sufficient profits are available for distribution and comply with any legal restrictions. Proper documentation is crucial to support the transaction's legitimacy. Additionally, both parties should consider the implications of withholding taxes, transfer pricing regulations, and reporting requirements to ensure compliance and avoid potential penalties.

Engaging with financial and legal advisors can help navigate these complexities effectively.

When establishing a branch office in Croatia, one significant advantage is the absence of withholding tax on repatriated profits.

This means that profits generated by the branch can be transferred to the parent company without incurring additional tax liabilities. However, while there is no withholding tax, it's essential to comply with local regulations and maintain accurate financial records.

The branch office must also adhere to Croatian accounting standards and tax laws, which include corporate income tax obligations. Engaging a local tax advisor can help ensure compliance and optimize tax strategies for repatriation of profits.

When representing a subsidiary on your Croatian balance sheet, it’s essential to adhere to the local accounting standards (Croatian Financial Reporting Standards, or CFRS). The subsidiary should be consolidated into the parent company's financial statements if it meets the criteria for control, typically having more than 50% of the voting rights.

Investment Recognition: The investment in the subsidiary is recorded at cost initially, reflecting the purchase price and associated costs.

Consolidation: Assets, liabilities, income, and expenses of the subsidiary should be combined with those of the parent company, eliminating any intercompany transactions.

Goodwill: If the acquisition cost exceeds the fair value of identifiable net assets, goodwill must be recorded and tested for impairment annually.

Reporting: The subsidiary’s financial performance must be included in the parent’s balance sheet, ensuring compliance with Croatian regulations for transparency and accuracy.

Proper representation provides a clear financial picture and aids in decision-making and regulatory compliance

Processing incoming or outgoing dividend payments on your balance sheet requires careful accounting to accurately reflect these transactions. Here’s a brief overview of the steps involved:

Record Dividend Income:

Update the Balance Sheet:

Declare Dividends:

Process Payment:

For both incoming and outgoing dividends, ensure that all entries are accurately recorded to maintain the integrity of your financial statements. Regularly review these transactions to confirm compliance with relevant accounting standards.

When operating a branch office in Croatia, understanding annual reporting deadlines and requirements is crucial for compliance.

Annual Financial Statements: Companies must prepare and submit their annual financial statements to the Croatian Financial Agency (Fina) within three months of the end of the financial year. This includes a balance sheet, income statement, and notes.

Tax Returns: The corporate income tax return must be filed by the end of the fourth month following the financial year’s conclusion. This includes both the statement of taxable income and the calculation of corporate income tax owed.

VAT Returns: If the branch is VAT registered, it must submit monthly or quarterly VAT returns, depending on the annual turnover, by the 20th of the following month.

Statutory Audits: Depending on size criteria (total assets, revenue, number of employees), a statutory audit may be required, which must be completed and filed alongside the financial statements.

Engaging a local accounting professional is advisable to navigate these requirements effectively.

When establishing a branch office in Croatia, companies must adhere to specific filing requirements to ensure compliance with local regulations:

Registration with the Croatian Court: The branch must be registered with the relevant commercial court, including details about the parent company and the branch's activities.

Tax Identification Number: Obtain a tax identification number from the Croatian Tax Administration, necessary for all tax-related obligations.

Annual Financial Statements: Branch offices are required to prepare and submit annual financial statements in accordance with Croatian accounting standards.

VAT Registration: If applicable, the branch must register for value-added tax (VAT) and file periodic VAT returns.

Income Tax Returns: Branches need to file annual corporate income tax returns, reflecting their profits generated in Croatia.

Statutory Audits: Depending on the size and nature of the business, an audit of the financial statements may be required.

Ensuring compliance with these filing requirements is essential for smooth operations and avoiding penalties in Croatia.

In Croatia, penalties for non-compliance with accounting and tax regulations can be significant. Businesses failing to register with the tax authority or submit required documents may face fines ranging from €1,000 to €20,000, depending on the severity of the infraction. Late filing of tax returns or financial statements can incur additional fines and interest on overdue payments.

Serious violations, such as fraudulent reporting or failure to comply with VAT regulations, may lead to criminal charges, resulting in higher penalties and potential imprisonment for responsible individuals. Maintaining compliance is essential to avoid these severe repercussions.

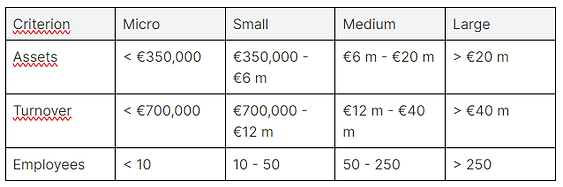

In Croatia, audit thresholds for companies are defined by the Accounting Act and related regulations. As of 2023, companies are required to undergo a statutory audit if they meet two out of three criteria in the previous fiscal year:

Micro and small enterprises typically have lower reporting obligations, often exempt from mandatory audits unless they surpass these thresholds. Companies should regularly assess their financial status to determine compliance with audit requirements, as this ensures transparency and adherence to Croatian law.

In Croatia, small and medium-sized enterprises (SMEs) are exempt from mandatory audits and chartered accountant requirements, simplifying compliance for these businesses.

SMEs can prepare financial statements in accordance with simplified accounting regulations, which reduces the administrative burden. This exemption applies as long as the company meets certain criteria regarding revenue and asset thresholds.

However, while audits are not compulsory, SMEs may still benefit from maintaining accurate records and consulting with accounting professionals for financial advice and tax compliance. This approach can help ensure sound financial management and facilitate growth opportunities in the Croatian market.

1. What qualifies as an SME in Croatia?

Small and medium-sized enterprises (SMEs) in Croatia are defined based on criteria related to employee count, annual turnover, and total assets. Generally, micro enterprises have up to 9 employees, small enterprises have 10-49 employees, and medium enterprises have 50-249 employees.

2. Are SMEs in Croatia required to have an audit?

No, SMEs in Croatia are not required to undergo mandatory audits as long as they meet specific revenue and asset thresholds. This exemption significantly reduces the administrative burden on smaller businesses.

3. What accounting standards should SMEs follow?

SMEs can prepare financial statements based on simplified accounting regulations set forth by Croatian law. This allows for a more straightforward reporting process compared to larger corporations.

4. Do SMEs need to keep financial records?

Yes, even though audits are not mandatory, SMEs must maintain accurate financial records for tax purposes and internal management. Proper record-keeping is essential for compliance with local tax regulations.

5. Can SMEs benefit from professional accounting services?

While not required, SMEs can benefit from consulting with accounting professionals. These services can provide valuable guidance on financial management, tax compliance, and strategic planning for growth.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!